Content updated 4 June 2025

Under most income protection policies, you will still be able to claim a benefit even if you are partially disabled from working.

What is considered a partial disability?

Most income protection policies will pay a benefit to you if you are either totally disabled or partially disabled. How insurance companies define partially disabled can vary, so it is important to check the definitions section in your Product Disclosure Statement to see how it is defined in your policy.

In summary, these terms are usually defined in the policy and will mean something like:

Totally disabled

You are unable to do the usual duties of your occupation, are not working and are following the advice of a doctor.

Partially disabled

You are unable to do at least one of the usual duties of your occupation, working in a reduced capacity for less income and following the advice of a doctor.

This means that if you are working reduced hours or reduced duties because of illness or injury, and you are getting paid less, you can usually claim a partial disability income protection benefit to top up the income you are earning.

Importantly, you usually need to have a period of time of being totally disabled, as defined above, before you can claim a partial disability benefit. It’s important to get advice about this before changing your work.

How do insurance companies work out what benefit I will be paid for partial disability?

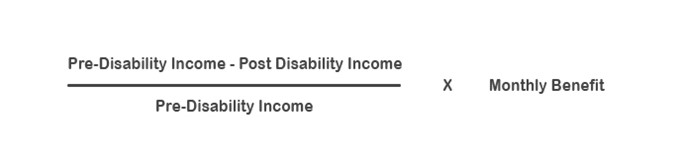

The formula used by insurers for working out how much your partial disability benefit is varies. Here is an example of a formula used by one insurer (remember, not all policies will be the same):

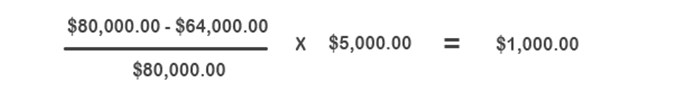

Consider the example of Dave

- Dave is an electrician who was on $80,000.00 and working full-time prior to injuring his back.

- He has income protection insurance which covers him for $5,000.00 per month.

- As a result of his injury, his doctor told him to cut down his hours to 4 days a week (which equates to $64,000 per annum wages).

- The partial disability benefit Dave is entitled to claim is calculated below:

Even though Dave is back at work, he is still entitled to claim an extra $12,000.00 per year through his income protection insurance.

Get help from an income protection lawyer

If you’re back at work in a reduced capacity after an injury or illness and are unsure about whether you’re entitled to claim a partial disability benefit, get in touch with today’s blog writer, Tom Cobban, for some free legal advice.

Contacting Berrill & Watson

📞 Melbourne: 03 9448 8048

📞 Brisbane: 07 3013 4300

📞 Anywhere else in Australia: 03 9448 8048

How we charge

We are Australia's best-value superannuation/insurance law firm. Other law firms charge nearly double (& sometimes more than double) what we charge. So, if you get a quote from them, or have a cost agreement, ask us what we will charge you.